WEBINAR:

Understanding Your Customer – Cannabis Consumer Archetypes

There are many different types of cannabis consumers, and each one has their own unique way of interacting with the plant. However, there are some general archetypes that most people fall into when it comes to their cannabis use. In this blog post, we’ll take a look at the most common archetypes and what makes them stand out from the crowd.

Spoke about this topic at a New Frontier Data webinar, where the company revealed their newest data set of cannabis consumer data. It’s all super fascinating, and well worth the read.

https://newfrontierdata.com/cannabis-consumers-in-america-2022/

On the webinar:

Dr. Amanda Reiman from New Frontier Data

Diane Downey from cannabis brand Rebel Spirit

Lilli Keinaenen, from Changemaker creative

Here’s the webinar recording:

About the report and company

What is New Frontier data?

New Frontier Data is the premier data and analytics firm specializing in the global cannabis industry. They research cannabis consumers and create informational reports and datasets that enable cannabis investors, advertisers, brands, researchers, and policymakers better understand consumers. Founded in 2014 by the amazing Giadha Aguirre de Carcer (who I totally have a professional and ahem, not so professional crush on!), they’re now a global company, following the entire globe’s cannabis business activity.

What’s in this report?

New Frontier Data’s latest report, Cannabis Consumers in America, Part Three: Identifying Key Archetypes, is a groundbreaking, three-part series providing new insights into how people use cannabis across the United States.

Based on brand new updated data collected since 2020 from 80,000 cannabis users reporting more than 200,000 experiences. Each reporting documented goals for why people used cannabis in that instance, what kind of products they used, doses, how effective the product was, and rated preferences. These reports got compiled into clusters of consumer types, so the report reveals larger consumption trends and purchasing behaviors. Amazingly useful for which cannabis product manufacturers and retailers (and us brand marketers!) can utilize when targeting and marketing to the U.S. legal cannabis market, projected to exceed $57 billion by 2030. Equally useful is understanding current legacy markets, which will eventually legalize, and or create cannabis tourism.

Why use data?

Gut feelings are great – but that is a surefire way to only market or create a brand based on what YOU like. You might be part of your target market, but you might also not be. I have to admit, reviewing this data from New Frontier, it challenged some assumptions I even had. So gut feelings are great, but there’s nothing that can beat having the actual data to base business decisions on!

New Frontier report: Consumer Archetypes

Key takeaways (aka the stuff that kinda blew my mind)

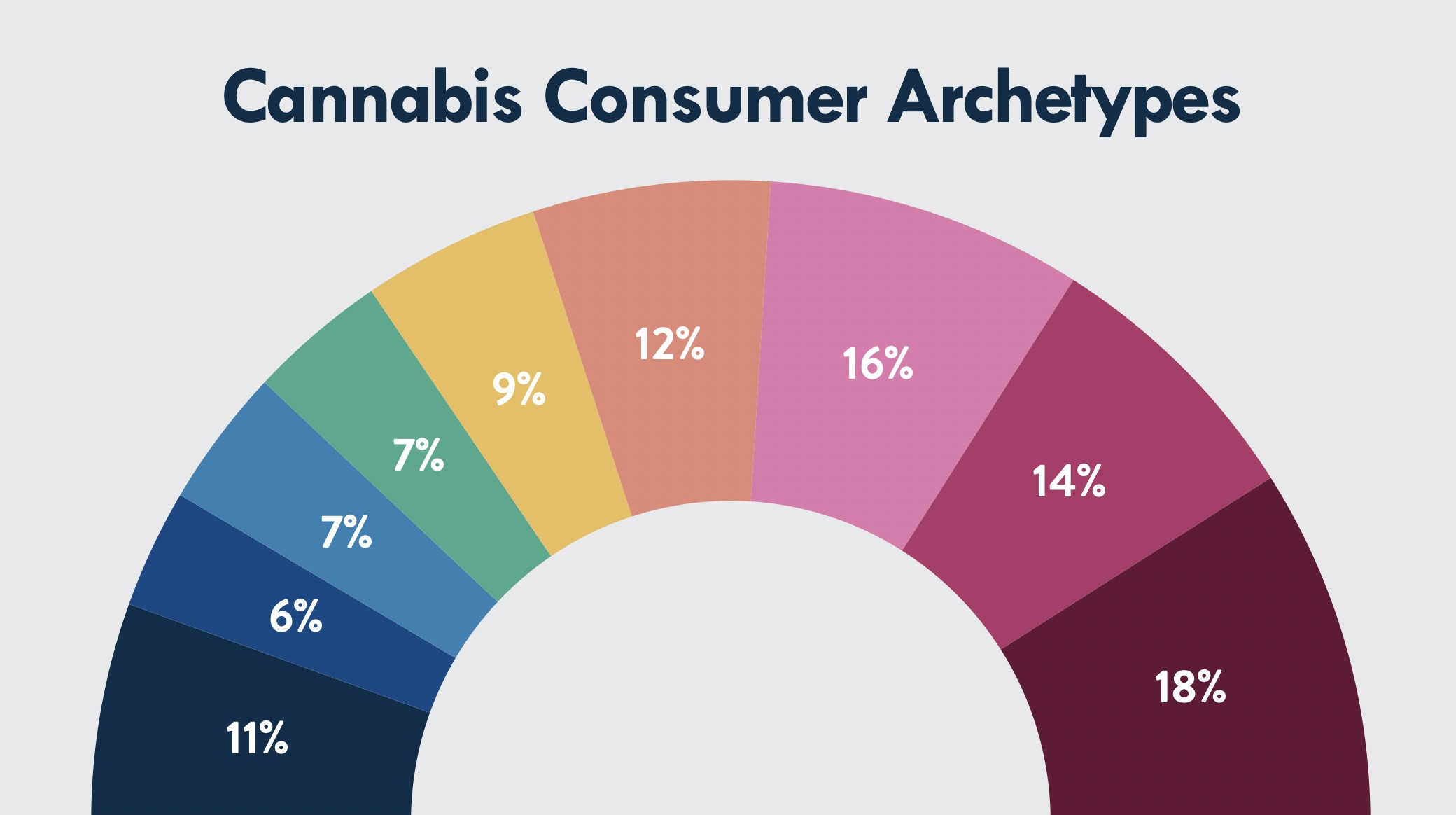

The market is very fragmented

Mirroring larger trends in consumer trends, the weed marketplace is very fragmented. No single archetype is the majority. Before this report, I assumed there was a majority consumer base, like that closer to half of the consumer base would be one type, the young dude. But this is not at all the case.

It’s pretty evenly gendered – women smoke weed too!

The breakdown of gender was another big shocker for me – across all the categories, male to female ratios were quite even. Just in a few of the archetypes did the gender balance skew one way or another. Holistic healers are almost 70% female (and older), this is the category that uses topicals for pain. But in other categories, it was more like a 60-40 split, swinging both ways depending on the category. Non-binary consumers clocked in at around 1% or less in most categories.

The cannabis market is fragmented – there’s no such thing as a “typical cannabis consumer”

Medical vs recreational – self identifying matters

There was a very clear chasm between whether you saw yourself as a medical cannabis consumer or a recreational consumer, not many doing both. This is very important, since depending on who you want to target, and what your product is for, it might need to look a certain way to attract the consumer you’re looking to reach. Overly fun and recreational looking cannabis packaging won’t work if your target audience is looking for a medical-grade cannabis product to help with their cancer symptoms or pain. And vice versa – recreational users don’t necessarily want to get messaging that is too much about illness. The most common use was for unwinding (rec) or stress (med), so there is some overlap in between that is about wellness.

Surprisingly, social use was not as common as I had assumed as the primary use. For the majority cannabis consumers, it’s more about relaxing by yourself and sleeping, than about smoking with friends, which wasn’t listed as the primary purpose for most consumers.

legal vs legacy markets

With so many states going legal, it was a shock to me that the average number for this report was 55% legal. Either a recreational legal market, or registered medical cannabis patient. The rest were either unregistered in a medical market, or living in an entirely illicit cannabis state that hasn’t legalized. Was not expecting that to be the number, worth remembering in our little bubbles, there’s a lot of people still out there.

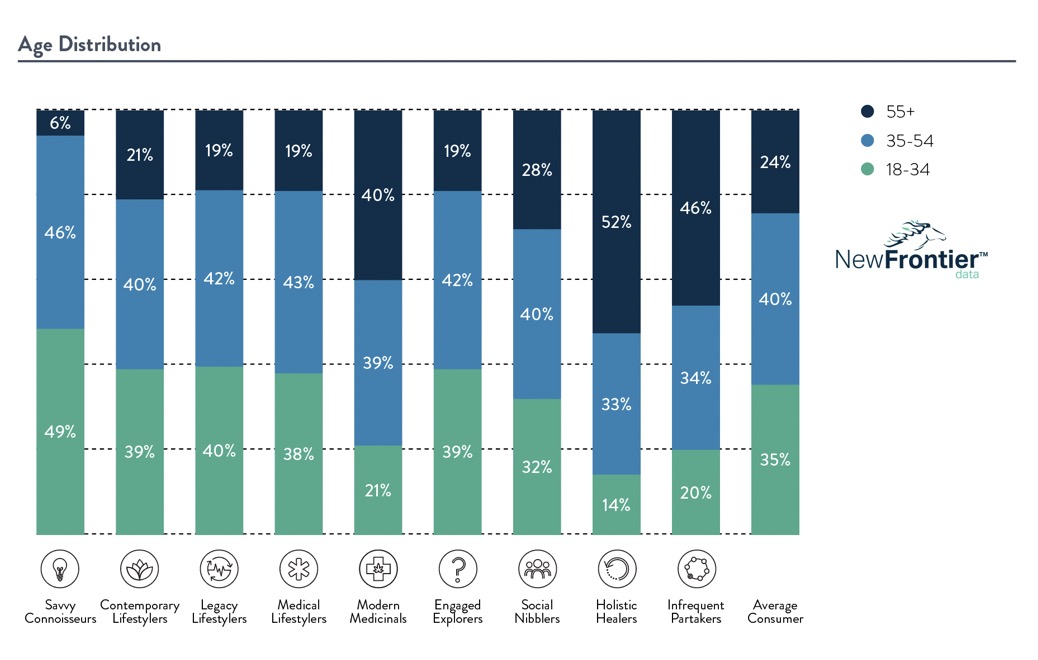

cannabis consumers are way older than you’d expect!

According to this report, the age breakdown of cannabis consumers on average is way older than the 20-something dudes we most assume are buying our stuff.

Key takeaways, and the archetypes described, and comments by a designer and marketer (me!)

The archetypes

SAVVY CONNOISSEUR CHARLOTTE

Charlotte moved from Montana to Southern California 10 years ago, after graduating with a computer science degree. She has been smoking cannabis prolifically since college. Now in her 30s, Charlotte still enjoys flower, along with most cannabis products, but has primarily transitioned to vapes as a means to discreetly manage her stress throughout the day. At home, she keeps a bar cart stocked with infused beverages and a few different kinds of edibles, depending on her mood. Charlotte enjoys trips to the dispensary and often shares newfound products with her friends.

Designer comments on attracting this archetype:

- No stigma or hangups

- Cannabis is a big part of their entire personality

- willing to experiment and try new things

- not turned off by “weedy looking” packaging

- enjoys or packaging that is entirely recreational and fun

- Unlikely to buy “ pink lady brands”

- knows enough about brands to pick the good stuff

- Seasonal, limited editions

- Also shops for her friends and relatives & tells everyone about it

- Spends time in store, the shopping is part of the experience

Weed celebrity brand crush

Seth Rogan’s Houseplant? Chelsea Handler?

The archetypes

CONTEMPORARY LIFESTYLER JEFF

Jeff is 40 and has lived in Washington State for his entire life. He primarily smokes cannabis labeled sativa, but also enjoys live resin edibles which he swears provide a completely different experience than either distillate or isolate-based edibles. Jeff used to start each day with a bowl, but has in the past few years switched to a tabletop vaporizer. He still smokes in the evening to unwind and help him sleep. Jeff uses a delivery service to resupply every other week; he usually buys the same brands unless something he is curious about is on sale.

Designer comments on attracting this archetype:

- No stigma or hangups

- High THC edibles

-

Proud stoner

-

Likely goes for whatever is on sale and strong and fire

- Practical shopper – buys for THC per dollar.

- In and out quickly – or orders the same stuff on delivery

-

probably claims to not make choices based on branding or packaging, but I’d guess he ends up buying “manly looking” packaging, prerolls and edibles, like in simple, black and white packaging

Weed celebrity brand crush

Celebrity crush: Snoop? Jay Z’s Monogram?

The archetypes

LEGAGY LIFESTYLER OTTO

Otto is 28 and lives in Austin, TX. He has known his dealer since they met during freshman year in college. Otto enjoys trying new strains, but without alternatives often purchases whatever his dealer has on hand. He regularly purchases upwards of 1/2 an ounce to share with his friends and family. He ends most evenings by sitting down in front of the TV and rolling a joint. Otto is intrigued by the idea of consumption lounges, but does not want to travel out of state for the same flower that he can buy at home.

Designer comments on attracting this archetype:

- Smokes whatever his dude has

- doesn’t care how it comes packaged

- would Otto experiment if he had more choice?

- what kind of manufactured cannabis products he would buy?

Weed celebrity brand crush

Celebrity crush: Marley’s? Willie Nelson?

The archetypes

MEDICAL LIFESTYLER GEORGE

George just turned 33 years old. In college he was a linebacker and suffered a series of football injuries which still cause him occasional discomfort. He has used cannabis for several years to avoid reliance on prescription medication, and to combat his insomnia. George has purchased edibles and topicals in the past, but prefers the immediate onset of combustible products. He makes a weekly trip to the dispensary to buy an 1/8th oz. of one of his favorite strains and some pre-rolls for walking his dog in the evenings.

Designer comments on attracting this archetype:

- Pain-specific content, not frivolous or silly

- Sports

- Could he be convinced to try topicals: patches? Pain cream?

- assuming he goes for the more medical looking products, that feel clean and trustworthy.

- he’s looking for relief, so packaging and brands that talk about pain.

- Practical looking and working packaging that isn’t annoying to open.

Weed celebrity brand crush

Ricky William’s Real Wellness or Al Harringtons Viola

The archetypes

MODERN MEDICINAL SHARON

Sharon is 52 and lives in Eugene, OR. She suffered from migraines for years, trying several prescriptions and OTC medications with limited success. Cannabis helps Sharon mitigate her symptoms. She dabbled with edibles, but tinctures — which allow her to dial in her dosage depending on what is needed that day — are her preferred products. Each month, Sharon drives to her local dispensary to resupply.

Designer comments on attracting this archetype:

-

Purpose driven products: migraine tincture

-

probably goes for something wellnessy, with words like sungrown, with the word farm or botanicals in the name.

-

Imagery of plants and wise holistic women imagery sunshine and flowers

Weed celebrity brand crush

Melissa Etheridge

The archetypes

ENGAGED EXPLORER TOM

Tom is 24, and last year moved from Alabama to Colorado with his fiancé. While as a teenager Tom had smoked with friends, entering the legal market was a game-changer. He enjoys bringing a vape pen to the bar most weekends, and has a dab rig at home for concentrates. There are three dispensaries within five miles of Tom’s apartment, and he visits each one regularly to see what new products are in stock. He is especially excited when he finds a new flavor of infused beverage or edible among his favorite brands.

Designer comments on attracting this archetype:

-

Younger, so less disposable income

-

Brands he might be into: Incredibles, Keef Sodas

-

Prime target audience for “cannabis as a lifestyle” imagery, images of relaxing and happiness and hanging out with friends.

-

Bright neon colors, fun illustrations

Weed celebrity brand crush

Cookies / Berner

The archetypes

SOCIAL NIBBLER SUZIE

Suzie is 21, newly graduated with a bachelor’s degree in business computing. Her roommate works in a bakery, and regularly experiments by infusing her favorite recipes with cannabis. Suzie rarely purchases her own cannabis, but sometimes taste- tests her roommate’s concoctions, and occasionally contributes for a larger “baked brunch” or movie night with friends.

Designer comments on attracting this archetype:

-

Doesn’t buy herself, but could be persuaded once she moves out of the roommates place

-

Would likely drink a beverage and enjoy cookies or chocolates with friends, if someone is sharing.

-

Once Suzie is a little older, she might pick up a habit of edibles and drinks at night, once she’s living on her own and starts getting stressed at work.

-

brands could include: CANN, maybe buying the CBD version first

Weed celebrity brand crush

Bella Thorne? or some gen z influencer I do not know

The archetypes

HOLISTIC HEALER ETHEL

Ethel is a 67-year-old recent retiree, volunteering part-time at her local library to stay busy. She used to be an avid runner, and still enjoys an occasional 5K run. Ethel’s first cannabis purchase was a broad-spectrum CBD topical found in the supplements section of her local organic market. Since then, she has discovered that full-spectrum THC topicals sold at a nearby dispensary effectively combat her joint pain. While she has tried edibles and tinctures, she remains primarily interested in the pain-management benefits which topicals provide.

Designer comments on attracting this archetype:

-

60s and in pain

-

Stigma around cannabis stores

-

likes CBD products because you can buy them from the health food store

-

doesn’t like the idea of having to go to a separate store, especially to one with loud music

-

She will feel most comfortable with products that look non-threatening and “normal”, like a cosmetic or health food product.

-

She will also need the packaging to be easy to open and have larger than 6 pt type.

-

Brands: Papa and Barkley, Humboldt Apothecary

Weed celebrity brand crush

Martha Stewart

The archetypes

ROBERT: INFREQUENT PARTAKER

Robert is 64 years old, and living in New Jersey. He tried cannabis with his friends back in the day, listening to King Crimson on vinyl. After a 26-year hiatus, one of Robert’s friends gave him a cannabis topical and a few joints, suggesting that they might help ease his lower-back pain. While the topical provided some relief, Robert found that he preferred the nostalgia of smoking flower. When next time his friend visited, he bought 1/4 oz. of flower, and now rolls a joint every few months to relax at the end of a long day. Supplemented by the occasional gift from Robert’s son, he will not soon need to buy any more flower.

Designer comments on attracting this archetype:

-

Likes the classics

-

probably veers towards packaging that looks nostalgic to him

-

psychedelic and rock and roll looking artwork

-

Farmers on pickup trucks and americana nostalgia

-

brands: Rubens Doobies, Mike Tyson bites

Weed celebrity brand crush

Santana, Jim Belushi, Grateful Dead